Use our Mega Millions payout and tax calculator to find out how much taxes you need to pay if you win the Mega Millions jackpot – for both cash and annuity options. But, for prizes greater than $5,000, you still owe federal taxes at a withholding rate of 24%. There is no state tax for California lottery winnings. How much tax do you pay on California Mega Millions winnings? How late can you buy Mega Millions tickets in California?Ĭalifornia Mega Millions ticket sales stop from 7:45 – 7:50 p.m. Powerball and Mega Millions Lottery Results Saturday, J11:56 pm Powerball: There was no jackpot winner in the Saturday, JPowerball drawing, but 2 lucky players matched the first 5 numbers for a 1,000,000 prize: 1 from California and 1 from North Carolina. long-range change is the regional-scale mega-state of California. Mega Millions drawings are held every Tuesday and Friday at 8:00 p.m. Twenty-one states have populations of less than 3 million (of these, seven have less. Prize amounts in California are paid on a pari-mutuel basis and will.

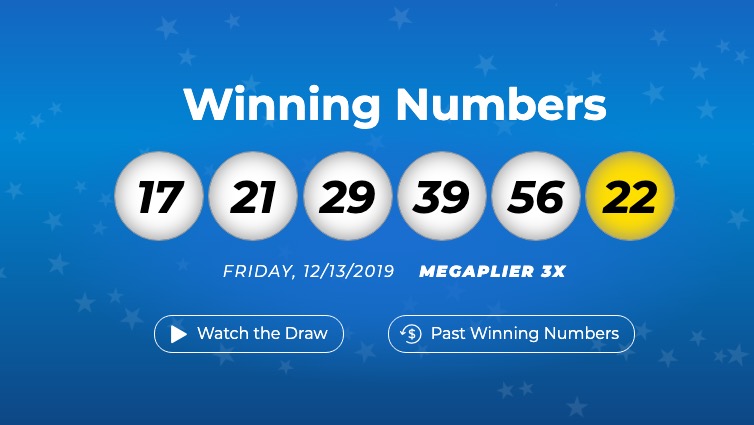

Unlike other states, California does not offer MegaPly ® that can increase your non-jackpot prize winnings by 2, 3, 4, or 5 times for an additional $1 per play When is the California Mega Millions draw? You win if the numbers on one row of your ticket match the numbers of the balls. You can also win non-grand prizes ranging from $1 to $1 million by matching one or more numbers as detailed in the California Mega Millions payouts and prize amounts chart above. You win the Mega Millions jackpot by matching all six numbers in the drawing. California Mega Millions FAQs How do you win the California Mega Millions?

0 kommentar(er)

0 kommentar(er)